The Morning Call

8/31/23

The

Market

Technical

Wednesday in the

charts.

https://www.zerohedge.com/markets/stocks-gold-gain-dollar-pain-soft-landing-narrative-implodes

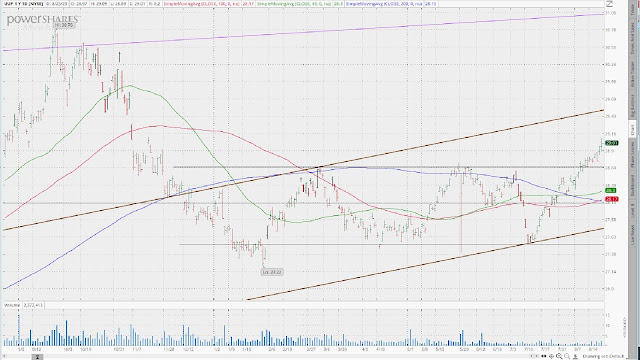

Note: the S&P continued

its climb, voiding that very short term downtrend, resetting its 50 DMA from

resistance to support and opening the way for a run higher. There is mixed technical opinion (see below)

on that point. And on the fundamental

side, stocks moving up on lousy economic data begs the question, has a

recession already been discounted? I

know that I said that I would be nibbling at equities if the S&P pushed

back above its 50 DMA. But with stocks

already handsomely priced, September being a notoriously bad month for the

Market and the sudden rush of poor economic data, I am too chicken to follow my

own advice. I am adding to our long Treasury position.

Will September

kill the Market’s bullishness? (Note:

the article was clearly written before S&P surge above its 50 DMA on

Tuesday. However, the remainder of the

article is still a reminder that September can be rough on your portfolio)

https://investorplace.com/2023/08/will-september-kill-the-market-bullishness/

Bad is good,

again.

Counterpoint.

https://www.zerohedge.com/markets/bad-news-good-news-juice-stocks-might-soon-run-out

Bonds to buy.

https://www.zerohedge.com/the-market-ear/big-bond-buy-0

Fundamental

Headlines

The

Economy

US

July pending home sales rose 0.9% versus

estimates of -0.6%.

July personal income

was up 0.2% versus predictions of +0.3%; July personal spending was up 0.8%

versus +0.7%.

The July PCE price

indicator came in at +0.2%, in line.

August initial

jobless claims totaled 228,000 versus consensus of 235,000.

International

July preliminary

Japanese industrial production was down 2.0% versus forecasts of down 1.4%;

July retail sales were up 2.1% versus -0.1%; July YoY housing starts were off

6.7% versus -0.8%; July YoY construction orders were up 8.7% versus +2.1%.

July German retail

sales fell 0.8% versus projections of +0.3%; the August unemployment rate was

5.7%, in line.

The July EU

unemployment rate was 6.4%, in line; August flash CPI was +0.6% versus +0.3%.

The August Chinese

manufacturing PMI was 49.7 versus expectations of 49.5; the August nonmanufacturing

PMI was 51.0 versus 51.1.

Other

Recession

An early warning?

https://www.capitalspectator.com/is-us-economic-resilience-peaking/

EV inventories piling up.

Investor home purchases crashing.

China

China’s unsustainable, unbalanced growth

model.

China attempts to

stabilize finances of troubled shadow banks.

How do we manage China’s decline?

https://www.nytimes.com/2023/08/29/opinion/china-economy-decline.html

Here is something new and different: an

analysis of the Chinese economy that isn’t totally downbeat.

https://www.advisorperspectives.com/commentaries/2023/08/30/china-contagion-contained

News on Stocks in Our Portfolios

What

I am reading today

The

last time (must read)

https://www.raptitude.com/2021/09/the-last-time-always-happens-now/

The

relentless rise of stablecoins.

https://marginalrevolution.com/marginalrevolution/2023/08/the-relentless-rise-of-stablecoins.html

Win big, lose

big---the range of outcomes.

https://www.mr-stingy.com/range-of-outcomes/

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.