The Morning Call

3/31/21

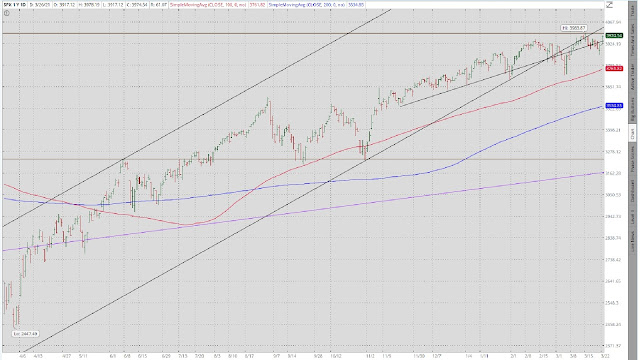

The

Market

Technical

Tuesday in the

charts.

https://www.zerohedge.com/markets/stocks-sink-feds-kaplan-admits-challenges-due-excess-risk-taking

Bulls run as liquidity

floods the Market.

Oil sells off.

https://www.zerohedge.com/the-market-ear/c3o1wmwfpk

Fundamental

Headlines

The

Economy

US

Weekly mortgage applications

fell 2.2% while purchase applications were down 1.5%.

Month to date

retail chain store sales declined at approximately the same rate as in the

prior week.

The January Case

Shiller home price index increased 0.9%, the same rate as in December.

March consumer

confidence was reported at 109.7 versus expectations of 96.9.

https://www.advisorperspectives.com/dshort/updates/2021/03/30/consumer-confidence-highest-in-a-year

The March ADP

private payroll report shows job increases of 517,000 versus predictions of

550,000.

https://www.zerohedge.com/economics/adp-employment-data-disappoints-march-service-sector-jobs-soar

International

Final

Q4 UK GDP grew 1.3% versus forecasts of +1.0%; business investment grew 5.9%

versus the Q3 report of 13.2%.

February

Japanese industrial production was down 2.1%

versus estimates of -1.2%; February YoY housing starts were down 3.7% versus

-4.8% in January; February YoY construction orders were up 2.5% versus +14.1%

in January.

The

February German unemployment rate was 4.5% versus 4.6% in January.

The

March Chinese manufacturing PMI came in at 51.9 versus consensus of 51.0; the

nonmanufacturing PMI was 56.3 versus 51.4 in February,

The

March flash EU CPI was up 0.9% versus +0.2% in February.

Other

Real house prices

and the price-to-rent ratio.

https://www.calculatedriskblog.com/2021/03/real-house-prices-and-price-to-rent.html

Median household income in February.

The Fed

Time to abandon autopilot monetary policy.

https://www.ft.com/content/835efc35-3688-4795-ada1-ecb566a3aa9d

Fiscal

Policy

Biden readies tax

hikes. Like Biden’s infrastructure spending

program, I am going to defend the

notion of tax hikes at least until we get more details.

https://www.nysun.com/national/now-he-tells-us-biden-readies-radical-tax-hikes/91460/

First of all,

there is no question that there is massive inequality in income. CEOs are earning multiples more than their

average employee---at a vastly wider margin than twenty years ago. I see that as unfair. A major reason is that CEO’s benefit from

stock buyback programs which, as I have pointed out numerous times, was made possible

by easy monetary policy, i.e., the company awards stock to CEO as part of his/her

compensation, company borrows money cheaply, uses the proceeds to buy back

stock (as opposed to investing to increase productivity) which drives the price

of said stock up, CEO sells stock. That

is just one of the many beefs I have with the current irresponsible monetary

policy; and it has contributed to the unbalanced distribution of gross income

in America. I see nothing wrong with raising

the tax rates on these gains---AS LONG AS the funds are used to either pay down

debt or fund productivity enhancing infrastructure projects.

Second, the

universe has known that the social security system was headed for bankruptcy but

no one in our political class had the cojones to address the problem. The math of the solution is pretty simple:

(1) cut benefits, (2) increase the social security tax, (3) raise the age at

which benefits are payable or (4) some combination of all. Whatever the correct mix, at least,

initiating legislation that deals this issue is a necessary first.

To be clear, I have

no idea whether the ultimate enacted solution will be a plus or minus for the

economy. But I like the fact that a

necessary conversation has been started.

More details.

Bottom line.

Who’s

next?

Today’s

Stock Market Lesson

The two most powerful forces in the Market.

https://compoundadvisors.com/2021/the-2-most-powerful-forces-in-markets

News on Stocks in Our Portfolios

What

I am reading today

Misdemeanor prosecution.

https://marginalrevolution.com/marginalrevolution/2021/03/misdemeanor-prosecution.html

More

reasons for optimism.

https://www.adamsmith.org/blog/reasons-for-optimism-population

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.