The Morning Call

8/28/23

The

Market

Technical

The S&P ended

the week slightly higher than where it started though it was a roller coaster

ride. The most significant point was it

touched the upper boundary of a very short-term downtrend and fell back. I read that as meaning the current correction

isn’t over though there are lots of pundits out there that disagree. Whatever the case, the S&P still hasn’t

set a bottom (so far) to this little retreat.

It could be nothing worse than the 8/18 low of 4329. But there are other candidates: (1) its 100

DMA [~4313], (2) the lower boundary of its short-term uptrend [~4183] and

(3) its 200 DMA [~4145]. That said, the mainstream consensus is that

this is just a sell-off in a bull market.

Whatever the case,

the task remains to wait till the S&P finds support, evaluate any new

economic data then make an educated guess based on the dataflow whether or not,

this is indeed a selloff in a bull market.

You know that I am skeptical; but if it continues to appear that

scenario is unfolding, I will put some money to work.

A

no-rules market.

All caught up?

https://www.zerohedge.com/the-market-ear/tme-weekend-all-caught

Setting up for a

bounce.

https://www.zerohedge.com/the-market-ear/setting-bounce-0

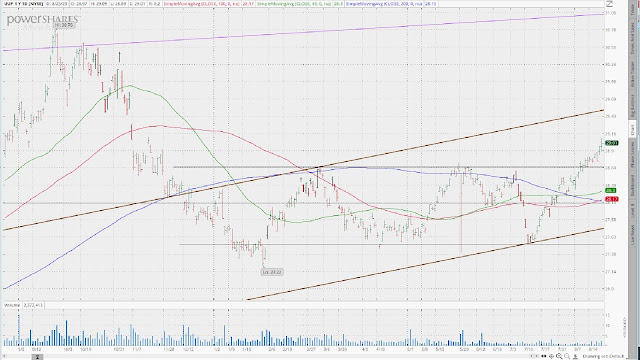

TLT’s chart is

still ugly on a long-term basis. However,

last week it did get something of a reprieve---making a sharp move up on

Wednesday. That is the good news. The bad news is that in doing so, it made a big

gap up, which as you know, I think will have to be filled. I think this pin action is more indicative of

the high level of investor uncertainty about recession/inflation than it is a

sudden turn in opinion. Of course, I am

subject to being wrong. So, we just have

watch the follow through.

Like the long Treasury, GLD made big reversal last week, voiding the test of its 200 DMA, but making a big gap up open in the process---which needs to be closed. Still, on a long-term basis, its chart is in good shape and there is no reason not to expect another challenge of its all-time high---especially, if bond prices continue to rally.

The dollar was up again---making its way to the

upper boundary of its short-term uptrend.

It clearly has the most solid chart on a short-term basis. But usually, a strong dollar is not a plus

for stocks; so, we need to keep that in the back of our minds as we watch

equities.

Friday in the

charts.

https://www.zerohedge.com/markets/hawkish-powell-horrible-data-spark-yield-curve-pain-nasdaq-gains

Fundamental

Headlines

The

Economy

Last Week Review

Another

slow week for economic data. What we got was balanced. Primary indicators were one positive, one

neutral, one negative. Overseas, the data was slightly negative.

The

results continue mixed---one week positive, one negative---keeping in question

whether or not (1) inflation is in the rear-view mirror and (2) we will get a

‘soft’ landing.

The

major economic event for the week was Powell’s speech at Jackson Hole. It was generally anticipated as being of a

hawkish tone and that is exactly what we got---meaning rates stay higher for

longer.

On

the other hand, there has been a growing lack of consensus about just how hawkish/dovish

the Fed needs to be (which I have tried to document in this letter) as it

relates to both (1) inflation and (2) recession. Which has made the prior narrative [inflation

in the rear-view mirror along with a soft land] questionable.

Part

of the reason for this growing disparity of opinion is simply the lack of

consistency in the numbers; and part the mounting concern about the health of

the Chinese economy, the world’s second largest.

This

all spells economic uncertainty and that tends to not be great for the Market.

For

the moment, I am sticking with my recession forecast though (1) my conviction

remains weak and (2) if there is one, I have no idea of its magnitude.

Economic

Downturn Still A Risk To Stocks - RIA (realinvestmentadvice.com)

I

am also maintaining my position that the Fed loosens at the first sign of

trouble. Although here too, my level of

certainty is quite low. In short, I am

just as confused as everyone else.

In

that kind of environment, the probabilities of a mistake in monetary and/or

fiscal policy rises and with it the odds of the one scenario that would screw

almost all investors/forecasters/current elected officials, i.e., either the

Fed sticks to its guns (made necessary by a lack of improvement in the

inflation stats), pushing the economy into a rough recession or the economy

falls into a severe recession of its own accord weighted down by years of

monetary/fiscal mismanagement.

Longer

term, irrespective of how low inflation goes in the short term, irrespective of

whether or not we have a recession and if so, how deep it will be, we are still

faced with an economy growing at well below its historic secular rate and a

base rate of inflation above 2%.

Correcting those self-inflicted wounds won’t be easy. It will take years

of fiscal and monetary restraint to do so. And that would mean less fiscal

stimulus and interest rates staying higher for longer than many now expect---which

unfortunately is not apt to happen.

Lance Roberts

agrees (must read)

https://www.zerohedge.com/markets/deficit-surge-will-lead-lower-rates-not-higher

The

Economy

US

International

The June Japanese

leading economic indicators index was reported at 108.9, in line.

Other

The

Fed

A bank failure few are talking about.

Fiscal Policy

The US budget deficit is exploding.

https://www.bloomberg.com/news/articles/2023-08-24/bond-market-flashes-warning-as-us-budget-deficit-surges?srnd=premium&sref=loFkkPMQ

Recession

US consumers

showing signs of stress.

https://www.nytimes.com/2023/08/25/business/consumer-retail-shopping.html?utm_campaign=What%20I%20Am%20Reading&utm_medium=email&_hsmi=271753357&_hsenc=p2ANqtz-_qvnrHArmWH9rqXx0cxcWZ55HUefCAzOm1AbAsu7oYFh6M2IiQIc0WI_S63LahQb7IyX1FMAL9nqP9JkiWNgg0TrO8gg&utm_content=271753357&utm_source=hs_email

Household debt at all-time high.

https://www.cnbc.com/2023/08/25/household-debt-is-at-an-all-time-high-but-2008-was-still-worse.html?utm_campaign=What%20I%20Am%20Reading&utm_medium=email&_hsmi=271753357&_hsenc=p2ANqtz--MWpX_4yf6FVi4R7jFSjoa_5dtKvo8LJVKSueVrOl32eXPxx2Db1cxoU2NecakGNrJjom2CUt8GoyGnayvhZj3JTLayA&utm_content=271753357&utm_source=hs_email

Bottom line.

The latest from BofA.

https://www.zerohedge.com/markets/nyet-zero-hartnett-warns-nasdaq-just-peaked-while-brics-11-end-globalization

News on Stocks in Our Portfolios

3M settles litigation over defective earplugs.

What

I am reading today

The state protects itself while crime

against ordinary citizens surges.

https://www.zerohedge.com/political/state-protects-itself-while-crime-against-ordinary-people-surges

******************************************************************************

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment