6/27/22

The

Market

Technical

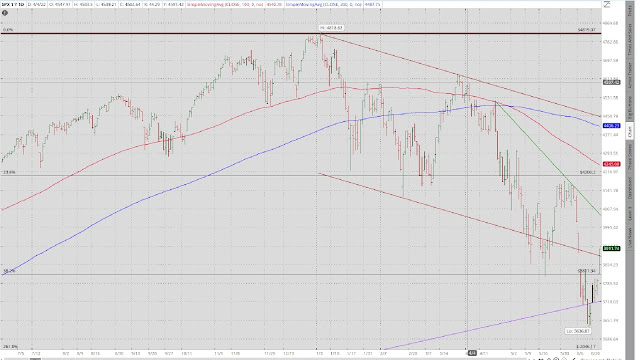

The S&P failed

in its challenge of the lower boundary of its intermediate term uptrend,

bouncing hard and demonstrating the powerful pull of those two huge gap down

opens. It managed to fill one of those gaps; and still has plenty of room the

close the second before it even challenges its very short term downtrend

(~4043). Remember that some of the most spectacular rallies occur in bear

markets. So, I still think it too soon to get jiggy.

Will $30 billion

in month end pension money send stocks higher?

https://www.zerohedge.com/markets/will-30bn-month-end-pension-buying-send-ush-sp-above-4000-kolanovic-thinks-so

The first real buying

in three weeks.

https://www.zerohedge.com/markets/first-real-buying-3-weeks-goldman-trader-explains-why-fridays-surge-start-next-big-move

The long bond

tried a second challenge of the lower boundary of its intermediate term trading

range and failed again. That said, it still has a lot of work to do to gain any

kind of upward momentum. But with investors now more concerned about recession

than inflation, the worst is likely over.

GLD is making its

third attempt to challenge the lower boundary of its very short term uptrend. Since

gold is usually inversely correlated to yields (yields down, gold up), I am

watching TLT for guidance on gold. As I noted above, the worst may be over for

the long bond (yields rallying); and if so, then GLD should hold its very short

term uptrend.

The

story remains the same. No matter how badly everyone wants the dollar to go

down, as long as the globe looks at the US as the safest place to invest, the uptrend

is not apt to change.

Friday in the

charts.

https://www.zerohedge.com/markets/stocks-soar-markets-price-end-fed-rate-hikes-recession-looming

Weekend

in the charts.

https://www.zerohedge.com/the-market-ear/forwardlooking

Commodities continue

to weaken.

https://www.zerohedge.com/the-market-ear/cbg8px30as

Goldman on the

near term Market direction.

https://www.zerohedge.com/markets/goldman-trader-top-question-hit-my-inbox-week-was-how-much-higher-can-we-go

Fundamental

Headlines

The

Economy

Review of last Week

Last week didn’t

produce a lot of economic data; what there was negative, though there were two

upbeat primary indicators. Overseas stats were quite negative.

The major headlines

of the week were:

(1)

Powell’s testimony before congress in which he reiterated

that the Fed’s primary goal at this time is to bring inflation down. The markets

called bulls**t on him as they are now discounting a recession and an early end

to tightening.

(2)

The bank’s passed their annual stress test with

flying colors. The importance of this is that when, as and if recession comes,

they will be able to manage it with little difficulty, meaning a 2008/2009

credit crisis is very unlikely.

As you know, I

originally thought that the US could avoid a recession (because the Fed would

chicken out before any economic deterioration got too bad), then went to a

neutral stance as the data got worse. And as they got even worse, I gave up the

ghost and acknowledged that a recession was the most likely scenario unless the

Fed quickly turns tail and runs back to QE which does not seem likely---barring a

500-1000 point flush in the S&P in the near future. (remember the Fed cares

as much about the Market as it does about the economy).

US

May durable goods

orders rose 0.7% versus estimates of +0.1%;

ex transportation, they were up

0.7% versus +0.3%.

International

The April Japanese leading economic indicators

came in at 102.9, in line.

Other

The chaos of the

post pandemic US economy.

https://brownstone.org/articles/the-spasmodic-chaos-of-the-post-lockdown-us-economy/

The Fed

Another gem from our ruling class.

https://www.zerohedge.com/political/new-bill-would-mandate-federal-reserve-promote-racial-and-economic-justice

Recession

Forget inflation, it’s a recession, stupid.

https://www.realclearmarkets.com/articles/2022/06/24/you_wont_find_inflation_anywhere_but_in_the_cpi_839064.html

Part 2.

https://www.ft.com/content/d572994d-f692-4de1-9bd4-1e8a3326a307

Recession risk rising.

https://www.capitalspectator.com/recession-risk-rises-but-us-still-expected-to-grow-in-q2/#more-18233

Geopolitics

The root causes of the Russia/Ukraine

conflict.

https://www.zerohedge.com/geopolitical/not-justification-provocation-chomsky-root-causes-russia-ukraine-war

Bottom line.

EPS growth

projections coming down.

https://www.zerohedge.com/the-market-ear/cwokes1img

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.