12/16/24

The Market

Technical

The S&P was flat on the week. But (w)hile

it has not filled the huge gap up open of 11/6 (a negative), it still has a

number of pluses going for it: (1) seasonally, it a positive time of the year,

(2) with Trump’s appointments, the long term economic outlook is improving [deregulation

and lower spending], (3) there has been few post-election disturbances.

So, my conclusion remains ‘the downside risk

to stock prices has been truncated.’

That said, it is early to be getting too

jiggy with a possible improving economic outlook. So, patience is still in

order---unless any purchases are strictly for a trade.

I continue to link to articles outlining (in the

authors’ opinions) the extent of current equity overvaluation. Plus, if you

accept the thesis put forward in the below article on government spending and corporate

profitability, then, your level of angst just went up a notch---I know mine did.

Of course, (1) stocks can always become more overvalued; and given the

favorable technical picture, they probably will and (2) there are a number of

stocks that are currently within my Buy Value Range. But I think that today

discretion is the better part of valor and that the best strategy is to await a

sell off to make any purchases. I am also looking to reduce any holdings that

are at or near their Sell Half range.

The VIX is cheap.

https://www.zerohedge.com/the-market-ear/buying-vix-here-simply-too-attractive-ignore

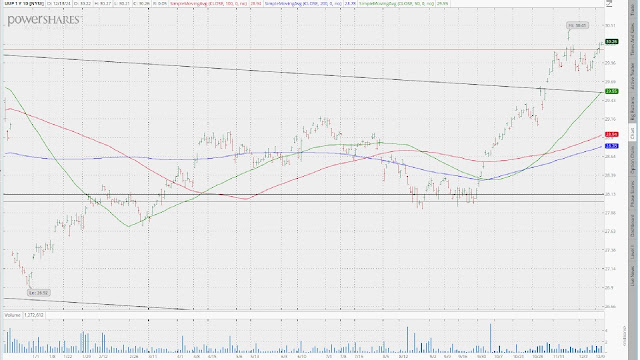

Not a good week in bond land. TLT was down big time

and on multiple gap down opens---adding to the already multitudinous gap up and

down opens of the last three months. As I noted last week that kind of behavior

simply adds to the already difficult task of figuring out short term direction.

However, from the long term point of view, the trend remains solidly to

the downside; and with growing evidence that inflation either is or may soon be

on the rebound, I see no reason to assume a reversal of that trend.

Gold was up on the week, though by a highly circuitous

route. In the process, it (1) made a slightly higher high which could prove to

be the terminator of a developing head and shoulders formation [though I am hesitant

to make that call] and (2) is challenging its 50 DMA. At this point, I remain

cautious pending follow through.

Watch the charts of gold and silver.

https://www.zerohedge.com/the-market-ear/gold-and-silver-charts-we-are-watching

The dollar rebounded nicely. The question now is

will it make another new high or a lower high. Fundamentals suggest the former.

But it is always prudent to let the Market give you the answer.

Friday in the charts.

Fundamental

Headlines

The Economy

Week

of review

Last week’s US economic stats were slightly

negative as were the primary indicators (zero plus, two neutral, one minus)---not

quite a perfect reading for my ‘muddle through’ scenario. But close enough for

government work.

The relationship between government spending

and corporate profitability. This is extremely important especially if you

think that Musk et al will be successful in reducing government spending.

https://www.advisorperspectives.com/commentaries/2024/12/13/kalecki-profit-equation-coming-reversion

Overseas, the numbers were balanced for a second

week in a row, building on the reversal of a developing trend of downward

momentum. Let’s hope conditions continue to improve---though recent rate cuts

by the ECB and Bundesbank suggest otherwise.

https://www.nytimes.com/2024/12/12/business/european-central-bank-interest-rates.html

The price data was all neutral or negative,

supporting my thesis that higher inflation is in our future. Policy comments

out of the future Trump administration regarding tariffs and tax cuts only raise

the odds that my forecast will come to fruition. To be sure, the cost cutting

proposals could be an offset but (1) Trump has the power to impose tariffs

unilaterally, and (2) it is a lot easier to get congress to cut taxes than it

is to cut spending.

The death of disinflation.

https://www.zerohedge.com/the-market-ear/rip-december-16th-2024-death-disinflation

Bottom line: my outlook remains: (1) the economy

‘muddles through’ and (2) inflation has likely seen its lows. But the level of

economic uncertainty is higher than normal, at least in the short term, and all

economic forecasts (including my own) should be viewed accordingly.

US

The December NY Fed manufacturing index came in at

0.2 versus consensus of 12.0.

International

November Chinese YoY industrial production was up

5.4% versus projections of +5.3%; November YoY retail sales were up 3.0% versus

+4.6%; November YoY fixed asset investment was up 3.3% versus 3.4%.

The December Japanese flash manufacturing PMI was

49.5 versus estimates of 49.2; the flash services PMI was 51.4, in line; the

flash composite PMI was 50.8 versus 50.2; the December German flash

manufacturing PMI was 42.5 versus 43.1; the flash services PMI was 51.0 versus

49.3; the flash composite PMI was 47.8 versus 47.5; the December EU flash

manufacturing PMI was 45.2 versus 45.3; the flash services PMI was 51.4 versus

49.5; the flash composite PMI was 49.5 versus 48.2; the December UK flash

manufacturing PMI was 47.2 versus 48.2;

the flash services PMI was 51.4 versus 51.0; the flash composite PMI was 50.5

versus 50.7.

Other

Unemployment claims as a recession

indicator.

Update on Q4 nowcasts.

https://www.calculatedriskblog.com/2024/12/q4-gdp-tracking-21-to-33-range.html

Another yellow flag.

https://bonddad.blogspot.com/2024/12/good-news-on-real-aggregate-payrolls.html

Fiscal Policy

The

potential power of DOGE.

https://www.realclearmarkets.com/articles/2024/12/13/the_potential_power_of_doge_1078299.html

The

great upheaval.

https://www.axios.com/2024/12/12/trump-elon-musk-great-upheaval-ai-politics

The

bogus accounting of a strategic bitcoin reserve.

https://www.cato.org/blog/tanstaafsbr-or-theres-no-such-things-free-strategic-bitcoin-reserve

Tariffs

China’s

trump cards in the coming trade war.

https://www.ft.com/content/bd3a0377-58a9-4283-b9c4-d7445b7d3df8

Investing

The latest from BofA.

https://www.zerohedge.com/markets/400-days-until-40-trillion-debt-michael-hartnetts-2025-playbook

Economic indicators and the trajectory of earnings.

Economic Indicators And The Trajectory Of Earnings

- RIA

Investing in the post-election optimism

atmosphere.

Trump Election Sends NFIB Optimism Surging - RIA

News on Stocks in Our Portfolios

What I am reading today

Surprising

treasure found after Notre Dame burned.

These are the surprising treasures

archaeologists found after Notre Dame burned

Visit Investing for Survival’s website (http://investingforsurvival.com/home) to learn more about our Investment

Strategy, Prices Disciplines and Subscriber Service.

No comments:

Post a Comment