The Morning Call

7/3/23

I am on vacation but

wanted to get last week’s summary out. I will remain on vacation through the 10th.

The

Market

Technical

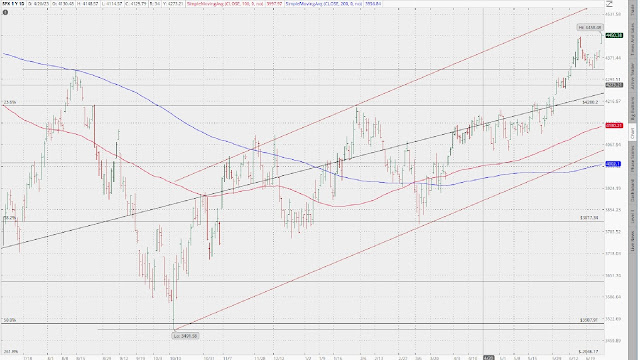

I opined in last

week’s Monday Morning Chartology that our task now was to ‘sit back and see

where the index can find support.’ Well,

it found support all right. After a down Monday, stocks were off to the races

culminating in a huge gap up open on Friday that marked a new higher high in

the current short-term uptrend. And in the process, it called into serious

question the whole negative sentiment/positioning narrative. Clearly, the trend

remains positive; though that gap up open needs to be filled.

TLT had an

interesting week. I say interesting because I can’t make a lot of sense out of

its pin action. It started the week challenging both DMAs, took a severe tumble

on Thursday (creating a major gap down open), then immediately reversed itself,

moving higher and closing the gap open.

Unlike stocks and

bonds, GLD maintained its current short-term trend---to the downside. However, ‘it

remains in intermediate and long-term uptrends. Nevertheless, support is a long

way away; so, there is lots of room for more downside before any real technical

damage is done.’

The dollar continued its very short-term trend to the upside. Like GLD, no erratic reversals here. It did touch its 200 DMA (now resistance) and backed off. Let’s see if it tries again. Not much information to be gleaned from this chart; though the stability in GLD and UUP contrasts sharply with the volatility (speculation?) in both stocks and bonds and suggests the need for caution.

Friday in the

charts.

Fundamental

Headlines

The

Economy

Last Week Review

Last

week’s US stats were overwhelmingly positive (five plus primary indicators, one

negative). Overseas, the data was downbeat but just so. It is becoming increasingly

clear that the rest of the global economy is slowing if not in recession---certainly,

Europe is.

On

the other hand, after a couple of weeks of disappointing US numbers, last week provided

max cognitive dissonance. As you know, I have a US recession in my forecast;

but based on over a month’s worth of upbeat stats, I was seriously considering

reversing that call. Then came a couple of weeks of disappointing numbers which

revived my confidence that a recession was in the offing. And now this. So,

color me confused. I am not giving up on the recession outlook; but once again

my faith in that forecast is being shaken.

The

other issue investors must deal with is, of course, inflation. And perhaps more

importantly, how the Fed perceives this problem and even more important, just

how firm is its determination to achieve its 2% target. We got more direction

this week from Powell who spoke at an international conference---in which he

reiterated that inflation remains a major concern and therefore, more rate

hikes were likely on the table.

That

said, as you know, I am quite skeptical of the Fed’s forecasting expertise---though

clearly last week’s data support the Fed’s hawkish stance---and have even less confidence

in its courage to maintain a restrictive monetary policy in the face of even

the slightest hint of economic/Market turmoil.

So,

despite Powell’s rhetoric, I have no great expectations that the Fed will stick

to its guns in pushing inflation back to 2%. Indeed, I believe that the only

way inflation gets back to 2% is on the back of a painful recession. To be

clear, I have no idea if we will have a painful recession.

Longer

term, irrespective of how low inflation goes in the short term, irrespective of

whether or not we have a recession and if so, how deep it will be, we are still

faced with an economy growing at well below its historic secular rate and a

base rate of inflation above 2%.

Regrettably, years of fiscal profligacy have left us with a debt to GDP

ratio far in excess of the boundary marked by Rogoff and Reinhart as the level

at which the servicing of too much debt negatively impacts the growth rate of

the economy. And years of irresponsible monetary expansion have led to the

misallocation of resources and the mispricing of risk.

Correcting those self-inflicted wounds won’t be easy. It will take years

of fiscal and monetary restraint to do so. And that would mean less fiscal

stimulus and interest rates staying higher for longer than many now expect---which

unfortunately is not apt to happen.

The

Economy

US

International

Other

News on Stocks in Our Portfolios

What

I am reading today

******************************************************************************

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment