The Morning Call

3/1/21

The

Market

Technical

The S&P hit an

air pocket last week. On Thursday, it finished

below the lower boundary of its short term uptrend and remained there through

the close on Friday. If it ends there

today, the short term uptrend will reset to a trading range. Let’s see what happens before speculating on

the meaning. At the moment, nothing has

changed: ‘while valuations continue to reach historical extremes, I can’t see an

end to this uptrend as long as the money keeps flowing with abundance and in

the absence of any major negative exogenous event.’

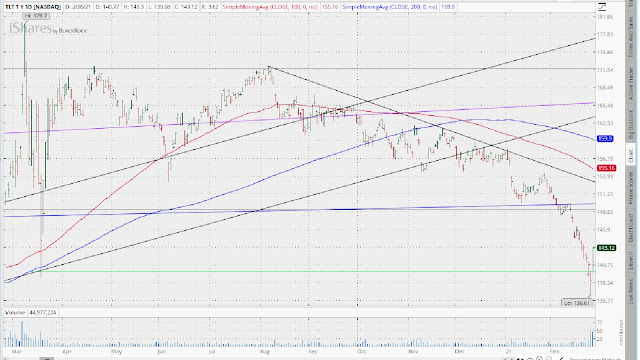

The long bond rallied

hard on Friday, finishing back above the lower boundary of its very short term

trading range, voiding Thursday’s break.

The question is, was this a dead cat bounce or is that lower boundary

providing good support, marking an end to the current seven month

downtrend? This is, of course, more than

a technical question; it involves investors conviction regarding higher

interest rates/inflation. Again, let’s

see what happens.

Unlike equity and

bond investors, gold investors do not appear to have many doubts about its

direction---and that is down. GLD got

crushed again on Friday. Importantly,

there is no visible support until it reaches the lower boundary of its very

short term uptrend (the upward slopping green line) and that is 10% below

current levels. However, remember, GLD got

overextended to the upside and can fall a good deal before any longer term

technical damage is done.

https://www.zerohedge.com/the-market-ear/c0dyirxmko

https://www.zerohedge.com/markets/bonds-bullion-suffer-worst-month-5-years-commodities-crypto-soar

Fundamental

Headlines

The

Economy

Review of the Week

The US data last

week was positive, including the primary indicators (three plus, one negative). That keeps the string of upbeat stats alive---long

enough that I think safe to conclude that the worst of coronavirus economic disruptions

are behind us.

Still, two

questions. ‘One, will the recovery

accelerate, closing the output gap in a short time or will the economy continue

to struggle to regain its historical secular growth rate? I think that this is the easier question to

answer because I see no reason to alter my assumption that the current grossly

irresponsible monetary and fiscal policies will act as a drag on economic

growth. So, while I expect growth to continue, I do not expect either its rate

of growth to match the levels reached as the economy bounced off the bottom or the

economy to close the existing output gap in the foreseeable future.

https://www.zerohedge.com/markets/redlining-us-economy-growing-fastest-pace-record-goldman-finds

Two,

will or won’t the economic recovery be accompanied by an increase in the inflation

rate that will push it to levels that historically have proven problematic for

both the economy and the securities’ markets?

This issue is a bit tougher to analyze.

At

first blush, it seems reasonable to assume that if economic growth remains

subpar, then there will be few upward price pressures aside for those

temporarily created by the dislocations due to coronavirus government restrictions.

On

the other hand, with the vast amount of liquidity sloshing around the global

economy, commodity prices could respond to speculation (as they appear to be

doing now). Throw in higher labor costs

resulting from an increase in the minimum wage and there is an argument for upward

supply side pressures. At present, I am

not convinced to the merits of this thesis.’

However, with each

passing day, bond investors increasingly are.

That doesn’t mean that they are right.

Plus, Friday’s pin action in the TLT may be indicating that the worst is

over. Patience.

https://www.zerohedge.com/markets/despite-fed-bond-market-hiking-rates

Overseas, the

stats were also positive---which is a plus for the US. Though as I have noted

previously, the recovery in Europe will likely be more anemic than our own.

US

International

The February

Chinese manufacturing PMI came in at 50.6 versus estimates of 51.1; the Chinese

Caixin (small business) manufacturing PMI was 50.9 versus 51.5; the nonmanufacturing

PMI was 51.4 versus 52.4 reported in January.

The February German

manufacturing PMI was reported at 60.7 versus expectations of 60.6; the EU manufacturing

PMI was 57.9 versus 57.7; the UK manufacturing PMI was 55.1 versus 54.9; the Japanese

manufacturing PMI was reported at 51.4 versus 49.8 in December.

February German

CPI was +0.6 versus consensus of +0.5%.

Other

The Fed

Powell changes the rules.

https://www.zerohedge.com/economics/powell-changes-rules-qe

News on Stocks in Our Portfolios

Altria (NYSE:MO) declares

$0.86/share quarterly dividend, in line with previous.

What

I am reading today

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment