The Morning Call

3/29/21

The

Market

Technical

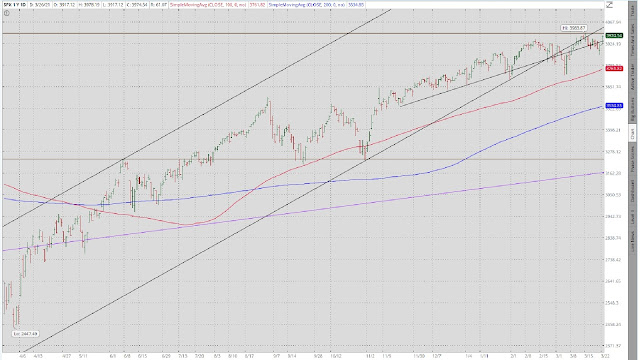

The S&P started

last week on its back foot but ended it

on a very positive note. Still, it (1) has

not regained the lower boundary of its former short term uptrend and (2) has not made a new high. But certainly, that finish is promising. Plus, it has plenty of support from both DMA

before it mounts a challenge of any other trend lines. As I said last week, the S&P recent

performance is more of a loss of upside momentum than a warning bell that more

downside is in the offing. My Market

assumption remains: ‘while valuations continue to reach

historical extremes, I can’t see an end to this uptrend as long as the money

keeps flowing with abundance and in the absence of any major negative exogenous

event.’

Is a massive fund

liquidating stocks?

https://www.zerohedge.com/markets/massive-fund-liquidating-stocks

The risk appetite

is soaring.

https://www.zerohedge.com/the-market-ear/ckmi9jwd09

Markets rally on

Powell’s easy money promise.

The long bond’s

performance last week was the mirror image of the S&P’s---starting the week

on a positive note but falling on Thursday and Friday. The good news is that

the lower boundary of its short term trading range is holding. The bad news is that if it doesn’t, there is

considerably more downside before it reaches support. I continue to believe that its current price

performance is and will be reflective of investor bets on inflation.

GLD remains in a

downtrend off its all-time high. But as I

have noted, gold was so extended to the upside, its current retreat has not

even broken its very short term uptrend.

Hence, further weakness seems reasonable especially with interest rates

and the dollar rising.

The dollar continues

its slow recovery and is poised to challenge its 200 DMA. This progress is likely a function of the US

being well ahead of most of the world in its coronavirus economic recovery. However, a strong dollar typically has a

negative impact on the economy (it makes our products more expensive to the

rest of the world) and a positive effect on inflation (it makes foreign goods

cheaper)---which does not exactly match up with the narrative on stocks and

bonds.

Friday in the

charts.

https://www.zerohedge.com/markets/media-momo-meltdown-small-caps-spacs-slammed-bonds-buck-bounce

New commodity supercycle?

https://www.zerohedge.com/the-market-ear/celgym4b5p

Fundamental

Headlines

The

Economy

Review of Last Week

US statistical releases

made for some pretty dismal reading last week.

The overall data as well as the primary indicators (four negative, one

positive) were overwhelmingly poor. That

said, much of it reflected February’s performance which was very adversely

impacted by weather. So again, I am not

really putting too much weight on these numbers, i.e. I do not think this

argues for any diminution of the outlook for continued economic recovery.

Overseas, the data

flow was the polar opposite---it was almost universally upbeat. The reason?

Most of it was from March. These

results build on those of the prior week, raising the hope of a meaningful

pickup in global growth.

The burden on EU

growth.

https://www.zerohedge.com/economics/eurozone-weakness-much-more-covid

Bottom line. The US

economy continues to recover aided by expansive monetary and fiscal

policies. That should be enough to

return growth to its prior long term below average secular rate. But I believe that those aforementioned policies

will put a lid on the economy’s secular growth; and indeed, could adversely impact

it via the ignition of inflationary forces.

US

International

Other

Update on big four economic indicators.

Used car prices up 3% in last two weeks.

https://www.zerohedge.com/markets/here-it-comes-used-car-prices-soar-3-just-last-2-weeks

The Fed

QE doesn’t work because it can’t.

The Fed pushes back against Summer’s

warning. (I remind you that the Fed has never, ever, ever in its entire

history tightened monetary policy before inflation got out of control.)

https://www.nytimes.com/2021/03/25/business/economy/larry-summers-federal-reserve.html

Bottom

line.

Ten dividend growth stocks to beat the Market.

Is bitcoin really a hedge?

https://www.zerohedge.com/crypto/henrich-bitcoin-hedge-myth

The latest strategy piece from Morgan

Stanley.

News on Stocks in Our Portfolios

AT&T (NYSE:T) declares

$0.52/share quarterly dividend, in line with previous.

What

I am reading today

Four factors in determining your

retirement withdrawal rate.

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment