The Morning Call

6/6/22

The

Market

Technical

While

the S&P ended down for the week, it remains in a very short term trading range.

What I am watching: (1) if it moves higher, can it mark a second higher high---which

would suggest the rally still has legs, (2) if it moves lower, will it [a]

decline modestly and mark a higher low---which would also be a plus or [b] will

it take out the May 20 low---which would not be good. This is a great time to watch and do nothing.

The

first thing that needs to happen is for stocks to stop going down.

https://allstarcharts.com/the-adorable-return-free-risk/

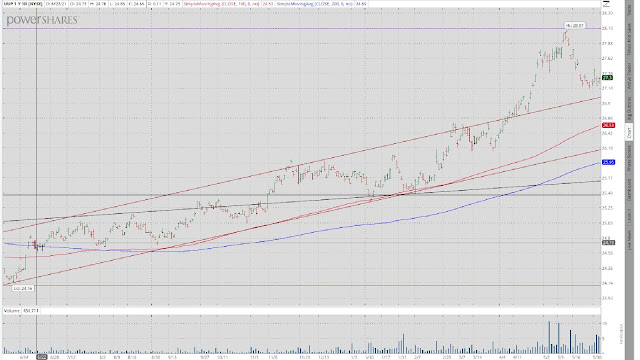

The long bond tried

to challenge that downtrend off its March 1 high but failed. So, another

challenge of the lower boundary of its intermediate term trading range appears likely.

Higher rates (tighter Fed) seem to be the worry.

In a fitful

trading week, GLD (1) held on to its bounce off the lower boundary of its very

short term uptrend, just barely marking a second higher high, (2) made its

first higher low and (3) remained above its 200 DMA [now support]. It continues

to look like the worst is over, though just barely.

The

dollar regained some traction last week, leaving it in a solid technical

position. It needs to lift from here; but as I said last week, even if it doesn’t

it has been so strong for so long, that no technical damage has been done

nor will it be done anytime soon. Everybody on the globe wants it to go down,

which is probably why it won’t as long as the investors believe that the Fed

will hang tough on raising rates and QT.

(as a reminder, I think that it will fold like a cheap umbrella).

Friday in the

charts.

https://www.zerohedge.com/markets/oil-pops-stocks-drop-hawks-hurricanes-killed-dead-cat-bounce

Technically

speaking.

Goldman: strength is to be sold.

https://www.zerohedge.com/markets/goldmans-bearish-view-strength-be-sold-while-longer

Fundamental

Headlines

The

Economy

Review of last Week

Last week’s economic

dataflow was negative as were the primary indicators (two negative, one

neutral, one positive). Overseas stats were slightly downbeat.

Another bad week,

so my neutral stance (even odds on a recession) keeps fading; though there are

enough positives to keep me in place. That said, if the trend remains

negative, I will need to further

downgrade my forecast.

‘That

said, the key variable in this equation is Fed policy, more specifically, how hard

is it prepared to fight inflation? History tells us that the most likely way of

curbing inflation is through recession. History also tells us that this group

running the Fed now lack cojones.

So,

the question here is that once the Market believes a recession is coming and

starts fully pricing it in (which it is already starting to do), (1) will the

Fed chicken out like it has every prior time since the Volcker regime and begin

reinflating the economy or (2) has the recession already started?’

Do I

believe history? Or do I believe Powell? I side with history; meaning the Fed

chickens out and if we get a recession, it will be a mild one.

US

International

Other

The

Fed

Monetary policy is all talk and always has

been.

The problem with a $31 trillion balance sheet.

Fiscal

Policy

Social Security and Medicare trust funds

nearing insolvency.

Yellen throws Biden under the bus.

Recession

Dimon’s storm warning.

https://www.nationalreview.com/corner/dimons-storm-warning/

This analyst expects recession to start soon.

https://www.zerohedge.com/markets/expect-deep-recession-start-quarter-or-early-third-quarter

Inflation

Our ruling class’s math.

https://www.zerohedge.com/markets/biden-pursuing-quickest-and-least-effective-way-fight-inflation

Oil soars.

https://www.zerohedge.com/commodities/oil-soars-markets-realize-what-opec-did

Bottom line.

In investing, simple

beats complex.

https://www.safalniveshak.com/simple-beats-complex-in-investing/

More on valuation.

https://www.advisorperspectives.com/dshort/updates/2022/06/02/p-e10-may-2022-update

Here is a counterpoint.

I would really like to know how Morningstar defines ‘fair value.’

https://www.morningstar.com/articles/1097165/us-stocks-are-trading-at-a-rarely-seen-discount

Changing market leadership

(must read).

https://www.advisorperspectives.com/commentaries/2022/06/03/bear-markets-signal-leadership-change

This week from BofA.

https://www.zerohedge.com/markets/hartnett-markets-summer-hell-begins-and-just-one-thing-can-stop-it

The absurd market hypothesis.

https://www.zerohedge.com/economics/absurd-market-hypothesis

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment