The Morning Call

6/13/22

The

Market

Technical

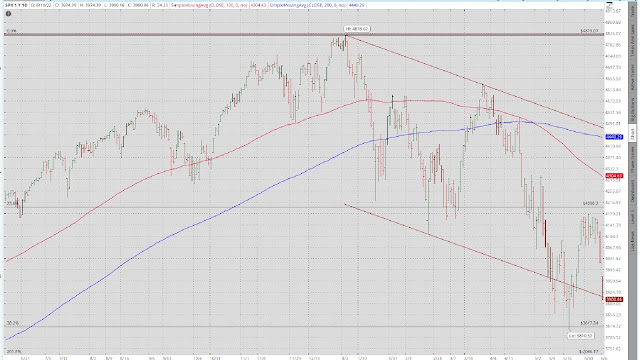

Given the pin action

on Thursday and Friday, it seems highly likely that the S&P will at least re-challenge

its 5/20 low and perhaps go on to test the lower boundary of its intermediate

term uptrend (~3709) and the 50% Fibonacci retracement level (~3507). But

notice the major gap down open on Friday. The question is, when does it get

filled---sooner or later. I am waiting to see how the S&P handles the aforementioned

5/20 low, and the ~3709 and

~3507 support levels before taking any action---I still have lots of cash left.

While the long

bond was down on Friday, it certainly wasn’t with the ferocity of equities. That

suggests that the bond guys are a lot less worried about inflation, a more

hawkish Fed, etc. than the stock jockeys. Another challenge of the lower boundary

of its intermediate term trading range may still be in the cards but odds of

success seem a bit lower to me.

GLD reacted as you

would think it would on a hotter

inflation number, bouncing hard on elevated volume. I said last week that I thought

the worst might be over; and this pin action just reinforces that notion. Gold

and silver are worth a look here.

The

dollar spiked on Friday as would be expected. Everybody on the globe wants it

to go down, which is probably why it won’t as long as the investors believe

that the Fed will hang tough on raising rates and QT. (as a reminder, I think

that it will fold like a cheap umbrella).

Friday in the

charts.

https://www.zerohedge.com/markets/soaring-cpi-crushes-peak-inflation-narrative-sparks-global-turmoil

Sentiment and

positioning do not suggest a bottom.

https://www.zerohedge.com/the-market-ear/bottom

Not

enough signs of a bottom.

https://www.zerohedge.com/markets/not-enough-signs-major-market-bottom

Fundamental

Headlines

The

Economy

Review of last Week

Last week’s economic

dataflow was very meager. What there was, was negative---with, of course, the

hotter than anticipated CPI number on Friday. Overseas stats were actually

positive.

As I noted, the big

kahuna was the inflation stat. Not only because inflation is not healthy for

the economy but also because it suggests that, if the Fed sticks to its guns,

then we will likely have tighter monetary policy for longer than hoped---which

not just a negative for the economy (i.e., it increases the odds of recession) but

also for the securities’ markets.

So, it looks like

my ‘no recession’ forecast took another one in the chops---though am going to

hold out for another week or two.

‘That

said, the key variable in this equation is Fed policy, more specifically, how hard

is it prepared to fight inflation? History tells us that the most likely way of

curbing inflation is through recession. History also tells us that this group

running the Fed now lack cojones.

So,

the question here is that once the Market believes a recession is coming and

starts fully pricing it in (which it is CLEARLY

starting to do), (1) will the Fed chicken out like it has every prior time

since the Volcker regime and begin reinflating the economy or (2) has the

recession already started?’

Do I

believe history? Or do I believe Powell? I side with history; meaning the Fed

chickens out and if we get a recession, it will be a mild one.

US

International

April UK GDP

growth was -0.3% versus estimates of +0.1%; April industrial production was down

0.6% versus +0.2%; the April trade balance was L-8.5 billion versus L-11.8

billion.

Other

Geopolitics

More sanctions on Russia.

https://www.zerohedge.com/markets/how-new-eu-sanctions-russia-will-shake-global-energy-trade

Bottom

line

This week from BofA.

https://www.zerohedge.com/markets/worse-anyone-realizes-dire-outlook-wall-streets-biggest-bear

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment