The Morning Call

3/14/22

The

Market

Technical

It

was another volatile week that witnessed a change in the S&P’s technical

picture; to wit, the index successfully challenged the lower boundary of its short

term trading range and reset to a downtrend. It still has the 23.6% Fibonacci

retracement level as very near in support. However, if it breaks that, then

~3800 is likely in our future.

The biggest pain

trade.

https://www.zerohedge.com/the-market-ear/ca07mbeig1

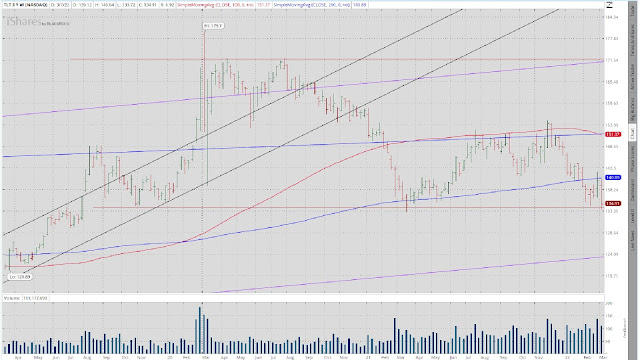

Like everything

else, bonds were active last week. In TLT’s case, it voided a very short term

uptrend and appears about to challenge the lower boundary of it short term

trading range---for the third time. The more times this support level holds,

the stronger it becomes.

https://www.zerohedge.com/the-market-ear/chjmmbl6ne

Credit

is cracking.

https://www.zerohedge.com/markets/credit-cracking

Gold did its best

Titan III impression last Tuesday, pushing up to its all-time high and nearing

the upper boundary of its short term uptrend then immediately reversed itself

and filled both those gap up opens---which is actually a positive for the

longer term. Despite the late in the week softness, my assumption is that it is

going higher. As I noted last week, if it can break though that all-time and

remain there, then there is nothing standing in the way of 3000-4000/oz.

Nothing in the dollar’s

story has changed, i.e., there is nothing on the horizon that would suggest a

weaker dollar. Plus, last week it managed to fill both of those gap up opens,

leaving it free to push higher. My assumption remains that irrespective of what

happens, investors continue to believe that the dollar is a safe place to be.

Friday in the

charts.

https://www.zerohedge.com/markets/bonds-stocks-commodities-crushed-because-putin

Fundamental

Headlines

The

Economy

Review of last Week

Last week was an

extremely slow one with regards to economic data. For all intents and purposes,

the US stats were mixed with no primary indicators reported. Ditto, overseas.

There is no way

one can draw any kind of meaningful conclusion from these results---so I won’t.

The outlook remains: the economy is

struggling to grow, hampered by irresponsible monetary and fiscal policies,

getting no support from the global economy and threatened by (1) seemingly

mounting inflationary forces and (2) continued supply chain disruption as a

result of the conflict in Ukraine.

Goldman slashes

2022 GDP forecast.

US

International

February German PPI came in at +1.7% versus estimates

of +2.0%.

Other

The problem with

the labor market is not too few workers, it is too low wages.

Can you say, ‘counterparty risk’?

The Fed

Bretton Woods III?

Fiscal Policy

Four thousand earmarks in the latest budget

act.

Inflation

Yellen says another year of ‘uncomfortably’

high inflation.

Geopolitics

It

is not only Russia that will be hurt by those sanctions.

https://www.zerohedge.com/geopolitical/rickards-sanctions-boomerang-putins-options

Bottom line.

150

years of S&P earnings and dividend yields.

News on Stocks in Our Portfolios

What

I am reading today

Archeologists

have found Shackleton’s shipwreck.

https://slate.com/technology/2022/03/shipwreck-shackleton-archaeology-discovery.html

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment