The Morning Call

5/8/23

The

Market

Technical

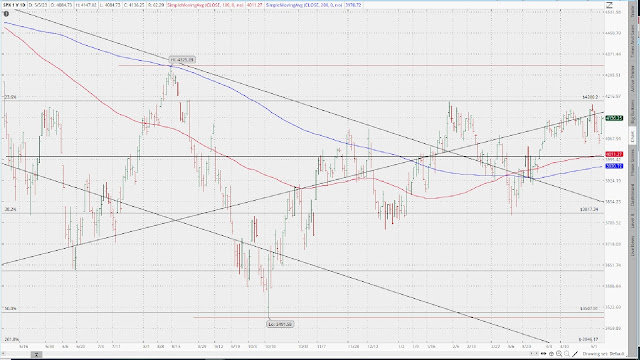

While the S&P was

down for the week, Friday’s rally (1) lessened the pain of the sell-off and (2)

prevented the index from making a lower low. In short, the S&P remains in a

trading range, fostered by the continuing uncertainty surrounding the odds of

recession, inflation and the Fed’s policy reaction to either or both. How is

that for confusing?

I do not think

that the Market goes anywhere until those issues are resolved---and as you

know, I don’t think that they will be resolved in manner positive to either the

economy or the Market.

The long bond ended up on the week. And like the prior week, it zigged and zagged though both DMA’s and continued to develop a pennant formation. Both suggest investor uncertainty which has been the theme of late in all our indices. So, at the risk of being repetitious, our only choice is to sit back and wait for the Market to figure out what it is going to discount next.

Gold was up but

tempered by a rough Friday price action. Confusingly, it pushed through its all-time

on Thursday only to make a huge gap down open on Friday. While it remains in

long, intermediate and very short-term uptrends and is above both DMA’s, I

wouldn’t buy or add to position until it can maintain some follow through to

the upside.

While the dollar declined last week, the pin action was enough to push it through the upper boundary of that developing pennant formation---though certainly not in a convincing manner. Still the lower boundary of that formation should provide support. That said, it has both DMA’s overhead that must be overcome to set it on an upward course.

Friday in the

charts.

https://www.zerohedge.com/markets/eod-3

Fundamental

Headlines

The

Economy

Last Week Review

The

US stats last week were the mirror image of the preceding week; that is, they

were down substantially. Even more so because while the primary indicators were

evenly split (2 & 2) but the two positive indicators were the strong jobs

numbers which is really a negative if you want the Fed to ease up on the rate

hikes.

HOWEVER,

there were also big adjustments to prior reports which negate the whole strong

employment narrative.

Those

revisions leave us where we started---a mixed picture for the economy but with

no clear near-term signs of a recession and certainly no sense of how deep it

may be if it occurs at all.

As

you know, I am not an optimist on this count; but to date, we are still lacking

sufficient evidence to back up a recession forecast, although some historically

accurate forward-looking indicators like the yield curve are still predicting

one. However, time is running out on the doomsayers. I am not conceding a no

recession/soft landing outcome yet but clearly my conviction is greatly

diminished.

Those

looking for a soft landing are in for a rude awakening.

That

said, I continue to feel comfortable with my below average long term secular

growth rate forecast.

The

other issue investors must deal with is, of course, inflation. And perhaps more

importantly, how the Fed perceives this problem and even more important, just how

firm is its determination to achieve its 2% target. While the data suggests

that inflation is very much with us, unfortunately the Fed has proven time and

again that that any sign of economic/financial/Market turmoil will result in

the immediate reversal of any tight money measures. So, if we rely on history,

the Fed won’t likely be the instrument of 2% inflation.

My

best guess is that there is a recession (though I have no clue regarding its

intensity) and that at the slightest hint of disruption, the Fed folds, leaving

inflation as an ongoing problem.

Though

Jeffrey Snider disagrees with me.

Bottom

line: longer term, irrespective of what happens over the next year, we are

still faced with a struggling economy growing at well below its historic

secular rate.

Regrettably, years of fiscal profligacy have left us with a debt to GDP

ratio far in excess of the boundary marked by Rogoff and Reinhart as the level

at which the servicing of too much debt negatively impacts the growth rate of

the economy. And years of irresponsible monetary expansion have led to the

misallocation of resources and the mispricing of risk.

Correcting those self-inflicted wounds won’t be easy. It will take years

of fiscal and monetary restraint to do so. And that would mean less fiscal

stimulus and interest rates staying higher for longer than many now expect---which

unfortunately is not apt to happen.

https://www.zerohedge.com/markets/why-our-national-debt-rises-good-times-and-explodes-higher-bad

The

Economy

US

International

March German industrial

production fell 3.4% versus consensus of -1.3%.

Other

The latest Atlanta Fed Q2 GDP

nowcast.

https://www.atlantafed.org/cqer/research/gdpnow

The Fed

Powell’s Bernanke

moment.

https://paulrlamonica.substack.com/p/jerome-powells-bernanke-moment

Recession

Credit card debt explodes.

The Banking System

Banking outflows

continue.

https://www.zerohedge.com/markets/deposit-outflows-continue-foreign-banks-bleeding-most

Bottom line.

The latest from BofA.

https://www.zerohedge.com/markets/hartnett-fed-hiked-until-it-broke-regional-banks

Profit margins improved again

in Q1 (but to continue a soft landing is needed)

Highlights from the Berkshire

Hathaway annual meeting.

https://www.zerohedge.com/markets/buffett-turns-gloomy-incredible-period-us-economy-coming-end

The coming changes in investment strategy.

https://www.zerohedge.com/markets/we-are-seeing-huge-soak-capital-skilled-labor-its-reverse-qe

News on Stocks in Our Portfolios

Illinois

Tool Works Inc. (NYSE:ITW) declares $1.31/share quarterly dividend,

in line with previous.

What

I am reading today

******************************************************************************

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment