The Morning Call

9/21/20

The

Market

Technical

The

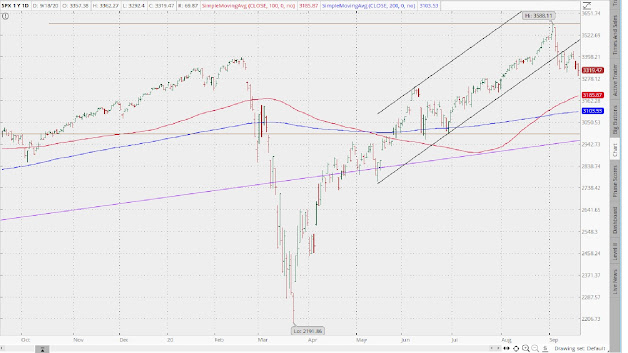

S&P remains above both DMA’s and in intermediate and long term

uptrends. Still, it is now developing a

very short term downtrend; although, there is lots of support at its 100 DMA,

200 DMA, and the lower boundaries of its short term trading range and

intermediate term uptrend. As you know, I

believe that the Market’s bias will remain to the upside as long as the Fed

continues to pump money into the financial system. However, shorter term, a test of one or more

of the above mentioned support levels would not be surprising.

I have been noting for the last month that the long bond was in a consolidation phase. Here you can see the series of lower highs and higher lows---typical of consolidation. A break of one those trends would point to a move in the direction of the break.

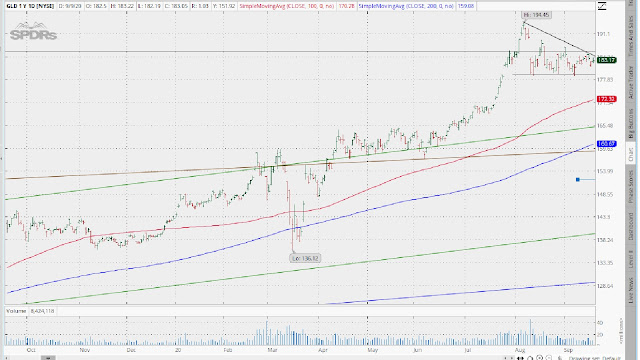

While

the longer term chart for GLD is positive, you can see that it has been in a fairly

tight trading pattern since early August---making progressively lower highs

(not good) but holding a minor support level (good). This is characteristic of consolidation. So, we wait for a break of one those trend lines

to give us directional guidance.

The

dollar has been in a solid declining trend since March and trades below both DMA’s. It made a low in early September near the

lower boundaries of both its short term downtrend and intermediate term uptrend

and since bounced. While it can’t make a

higher high, it is holding above that last lower low. However, it needs to successfully challenge

the short term downtrend before assuming that any recovery is taking place.

I can’t glean anything

of informational value from the VIX chart.

Friday in the charts.

Fundamental

Headlines

The

Economy

Last Week in Review

The stats

last week were negative as were the primary indicators. This adds more evidence to the notion that

the economy is improving but not likely in ‘V’ shape that is hoped for. Overseas,

the indicators were overwhelmingly positive---which continues the pattern of irregular

growth. I think that unfortunately their

sluggish performance will serve to restrain our own growth.

In other news, both the Fed and the Bank of England

held their regular meetings and, like the ECB in the prior week, left rates and

QE unchanged. So, the beat goes on.

Whatever the

shape of the recovery, I am not altering my belief that long term the economy

will grow at a historically subpar secular rate due to the twin burdens of

egregiously irresponsible fiscal and monetary policies---which, by the way, are

becoming even more egregiously irresponsible as a result of measures being

taken by the government and the Fed in dealing with the current crisis.

US

The August Chicago Fed national activity index

was reported at .79 versus estimates of

1.95.

International

Other

The

latest Q3 nowcasts.

https://www.calculatedriskblog.com/2020/09/q3-gdp-forecasts_18.html

You do not solve

lockdowns with more central planning (must read).

Global debt is exploding.

https://www.zerohedge.com/markets/global-debt-exploding-shocking-rate

The

Fed

Fed weighs a second stress test and capping

bank dividends.

The

coronavirus

Nearly 60% of coronavirus business closures are

permanent.

https://nypost.com/2020/09/17/majority-of-covid-19-business-closures-are-permanent-report/

China

Why China’s recovery is not what it seems.

https://ftalphaville.ft.com/2020/09/15/1600190531000/Why-China-s-recovery-is-not-what-it-seems/

Bottom

line. It ends when the money runs out.

https://www.zerohedge.com/markets/newton-physics-market-bubble

Part 2: The hazards of being in the grips of

growth mania.

https://www.zerohedge.com/markets/brilliant-brain-dead-risk-timing-manic-markets

Where value resides.

https://www.zerohedge.com/markets/tug-war-across-markets-hides-trade-lifetime

News on Stocks in Our Portfolios

Cisco: a bargain in the tech sector.

What

I am reading today

Ten

easy ways to save $870,000.

https://www.marketwatch.com/story/10-easy-ways-to-save-870000-2020-09-17

How

big money is powering the search for alien intelligence.

https://www.sciencemag.org/news/2020/09/how-big-money-powering-massive-hunt-alien-intelligence

The

bill for economic inequality is coming due.

https://www.zerohedge.com/markets/bill-americas-50-trillion-gluttony-inequality-overdue

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment