The Morning Call

1/3/22

The

Market

Technical

As

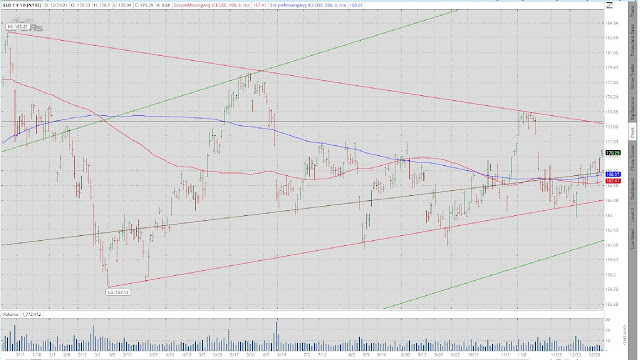

it did so many times in 2021, the S&P successfully challenged the upper boundary

of a short term trading range, resetting to an uptrend. There is the possibility

that this could be a false breakout fueled by a Santa Claus rally. However, for

the moment, I think that we have to assume that the bulls remain in charge and

the direction is up.

While the long

bond has trended downward over the past two weeks, it remains (1) in very short term uptrends off its March

and October lows as well as in intermediate and long term uptrends and (2)

above both DMA’s, having unsuccessfully challenged its 100 DMA. This is

supportive of the notion that inflation will not be the problem many think but

rather it is that ‘Powell waited too late to get hawkish and

now the Fed will be tightening into a weaker economy---thereby making it even

weaker.’

GLD maintained its upward bias over the last two weeks. In the process, it (1) challenged both of its DMA’s, both unsuccessfully during last week and (2) remained within the narrowing pennant formation [two straight red lines]. I noted in the last Monday Morning Chartology that its pin action is suggesting higher inflation while those of the long bond and the dollar do not. That is still the case though with gold a touch higher and the long bond and the dollar a bit lower, it is less so.

The dollar drifted

lower over the last two weeks but remains solidly in its short term uptrend and

above both DMA’s. So, I don’t see any inflation fears in its price performance.

What

is bothersome to me is these charts are suggesting that the Fed has timed the

tapering perfectly, that is, soon enough to slow the growth of inflation with

just enough tightening to assure continued economic strength. As you know, I am

coming around to the notion that inflation may be at or near its peak but not

because of anything positive that the Fed is done. Indeed, I believe that if it

is peaking, it is because the enormous burden that irresponsible money and

fiscal policies have placed growth prospects for the economy. In short,

inflation may not prove an enduring problem but a struggling economy made worse

by tightening monetary policy could be.

Friday in the

charts.

https://www.zerohedge.com/markets/stocks-bonds-bid-musk-mulls-imminent-recession

Fundamental

Headlines

The

Economy

Review of the Week of

12/20

The US stats weighed

to the positive side as did the primary indicators (three plus, two neutral and

one negative). Overseas, the data were overwhelmingly negative for the third

week in a row.

Review

of the Week of 12/27

This week was dead.

In the US there were only nine datapoints (no primary indicators) and they were

evenly split. Overseas, it was even quieter. Only two indicators---one plus,

one minus.

My take on the economy

remains unchanged---it is struggling to grow, hampered by irresponsible

monetary and fiscal policies, getting no support from the global economy and

threatened by (1) seemingly mounting inflationary forces and (2) a more severe than

anticipated retreat in economic activity---the result of the Fed that likely waited

too long to start tightening.

$29 trillion and

counting.

https://compoundadvisors.com/2021/29-trillion-and-a-change-in-the-american-psyche

US

International

The final December

German manufacturing PMI came in at 57.4 versus estimates of 57.9; the final

December EU manufacturing PMI was 58.0, in line.

Other

News on Stocks in Our Portfolios

What

I am reading today

Are

we that virtuous?

https://www.zerohedge.com/political/ungracious-and-their-demonization-past

New images from Mars.

War with Russia. Really?

https://www.zerohedge.com/geopolitical/david-stockman-prospect-world-war-iii

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment