The Morning Call

10/11/21

The

Market

Technical

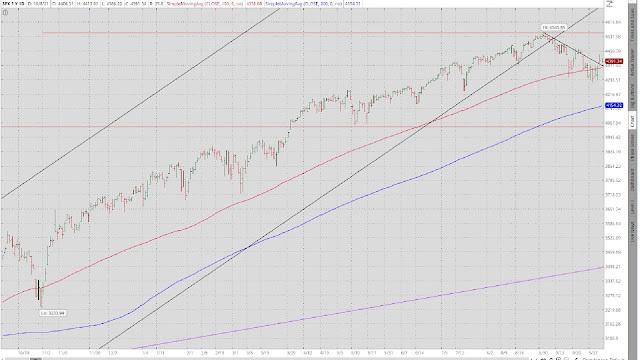

The S&P had a

good week, successfully challenging its 100 DMA (now support) and trading above

the downtrend off its 9/2 high. That

leaves little resistance between its current level and a challenge of that 9/2

high. That said, Thursday’s gap up open

needs to be filled and would mean some backing and filling before the advance

could take place. With all the recent

volatility, which may continue, it is a good time to do nothing.

Buy protection when you can not when you must.

https://www.zerohedge.com/the-market-ear/vix-hedges

Is the 2021 bear

market over?

https://www.zerohedge.com/markets/great-bear-market-2021-finally-over

The long bond continued

its plunge, reverting its 200 DMA to resistance. It seems pretty clear that the bond guys are

anticipating higher inflation and an end to QE---a scenario that you would

think that the stock guys would not like.

EU rates on the rise.

https://www.zerohedge.com/the-market-ear/cznslcylus

GLD piddled around for the second week in a row. Amidst all the volatility in the stocks and

bonds, I thought that it would spill over into the gold market. That said, there has been a lot of chatter lately

about bitcoin replacing GLD as the go-to store of value; and that may explain

gold’s sleepy behavior as stocks and bonds see saw dramatically. It is something to watch and consider.

The dollar was up

on the week but still closed below the prior Wednesday’s high. The bias is clearly to the upside though the

upper boundary of its very short term trading range (green line) is posing some

resistance.

Historically, a

strong dollar and higher interest rates have not been particularly good for

stocks (corporate earnings). Sooner or

later, something has to give.

Friday in the

charts.

https://www.zerohedge.com/markets/jobs-jolt-dulls-debt-limit-delay-gains-crypto-crude-surge

Fundamental

Headlines

The

Economy

Review of Last Week

The US data

releases were slightly negative while there was one negative and one neutral

primary indicator. So, struggling growth

remains my characterization of the economy.

Overseas, the numbers were slightly positive---for a second week in a

row. A plus to be sure; but the overall

trend is flat to down---so, no help for the US.

The congressional

cat fight over the debt ceiling, funding the government, the $1.5 trillion

infrastructure bill and the $3.5 trillion giveaway to the democratic base

continued. So far, the news is mildly upbeat. The government can remain in business through

December. Joe Manchin remains a hold out

for a smaller giveaway bill ($1.5 trillion).

If it is Washington as usual, he will get ‘bought off’ with some extra

perks for West Virginia (and himself?) and the taxpayer will get saddled with

the ‘compromise’ sum. The only hope is

that the progressives refuse to compromise and nothing passes. Stay tuned.

Bottom line. Following the initial snapback from the

lockdown, the US economy appears headed toward its former subpar secular growth

rate, stymied by an irresponsible mix of fiscal and monetary

policies---unfortunately with the growing risk of nontransitory inflation.

I like Jeffrey

Snider’s work; and I think this article helps explain the lackluster prospects

for economic growth post recovery.

However, with the growing number of headlines on inflation, especially

those on rising wage demands (cost push inflation), I have a tough time

excepting the premise that the lack of bank lending means lower/stagnate

inflationary pressures. Indeed, the lack

of bank lending to say the oil industry could very well lead to shortages and,

hence, higher prices.

US

International

September YoY Japanese

machine tool orders were up 71.9% versus up 85.2% in August.

Other

Inflation

Fertilizer prices hit new high.

China

China’s

energy crisis.

Bottom line

More on valuation.

https://www.advisorperspectives.com/dshort/updates/2021/10/07/is-the-market-still-overvalued

More gloom from Morgan

Stanley.

https://www.zerohedge.com/markets/morgan-stanley-doubles-down-doom-calls-fire-and-ice-correction

And

from SocGen.

https://www.zerohedge.com/markets/albert-edwards-its-starting-feel-bit-july-2008

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing for Survival’s

website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment