The Morning Call

7/11/22

The

Market

Technical

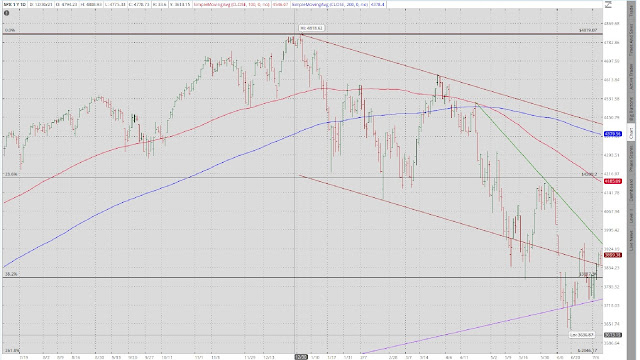

The good news is

that the S&P failed in its challenge of the lower boundary of its

intermediate term uptrend back on 6/21 and still has a huge gap down open that

needs to be filled. The bad news is that it remains (1) below both DMA’s, (2)

in a short term downtrend, (3) in a very short term downtrend and it (4) has

yet to make higher high. Visually you

can see the developing wedge pattern formed by the upper boundary of its very short term

downtrend and the lower boundary of its intermediate term uptrend. That is apt

to get resolved in the next two weeks as second quarter earnings get reported

and the FOMC meets. Patience.

The long bond is

attempting its third challenge of the lower boundary of its intermediate term

trading range. I await the results. That said, I continue to think that with

investors now more concerned about recession than inflation, the worst is likely

over.

In my absence, GLD

clearly got torched, likely in harmony with declining bond prices. In the

process, it voided its very short term uptrend. I put in a longer term chart to

give you a sense of where support lies. Unfortunately, it is considerably lower.

Still, it has a long way to go to break its long term uptrend. Further, sentiment

and the supply/demand dynamics for physical gold are improving. This is not the

time to be buying.

The

story remains the same---up, up and away. The dollar has reset its intermediate

term trend from a trading range to an uptrend. I used the longer term chart on

UUP also to give you an idea of future resistance. My conclusion is unchanged:

no matter how badly everyone wants the dollar to go down, as long as the globe

looks at the US as the safest place to invest, the uptrend is not apt to

change.

Friday in the

charts.

https://www.zerohedge.com/markets/commodities-crushed-bonds-battered-stocks-dollar-soar

The

latest from the Stock Traders’ Almanac

https://jeffhirsch.tumblr.com/post/689065982486085632/get-ready-for-the-quadrennial-rally

Fundamental

Headlines

The

Economy

Review of last two Weeks

Week of 6/27

The US data that

week was overwhelmingly negative as were the primary indicators (one positive, one neutral, three

negative). Overseas, the stats were slightly upbeat.

Week of 7/4

The US numbers that week were positive with

one plus primary indicator. Overseas, the

results were mixed.

The one notable headline

last week was the narrative of the latest FOMC meeting’s minutes---which were

more hawkish than anticipated. If the Fed truly follows through with its stated

policy, then I think that pretty much locks in a recession. The question now

is: how bad will it be?

Judging by the

current relative mild weakening in the data flow and the increasing likelihood

that inflationary pressures are starting to lessen, we could get a mild

recession. But that will depend on

(1) how far the

inflation rate falls. My concern here is that given the prolonged period and

the magnitude of monetary ease, that it will not be by much. In that case, to

get back to a lower stable inflation rate and a return to the Market

determining the price of risk, it would require some pretty harsh medicine from

the Fed,

(2) which brings

me to the second point: how the Fed reacts to the data. History suggests that

it will not tolerate a weakening labor market and/or a flush in the stock

market for very long before easing back irrespective of the underlying

inflation rate.

Jeffrey Snider

believes that we just need to watch the Treasuries market to know when the Fed

is starting to ease.

Of course, this is

all just speculation at this point because we do not know how deeply embedded

inflation is and we can’t say for sure that Powell won’t stand as tough as he

says that he will.

Which leaves the

outlook for the economy and, more importantly for investors’ purposes,

corporate profits murky at best. The good news is that second quarter earnings

season starts this week which will hopefully cast some light on the latter

point.

https://investorplace.com/2022/07/a-market-breakout-is-coming/?utm_source=rcm&utm_medium=editorial

In the meantime,

patience is virtue,

US

International

June

Japanese YoY machine tool orders were up 17.1% versus estimates of

+8.0%.

Other

Recession

Eight measures of a slowing economy.

https://www.nytimes.com/2022/07/08/business/economic-indicators-showing-slowdown.html

A cascade of defaults is coming to developing

,markets.

China has similar problems.

https://www.ft.com/content/3339c433-c441-40fb-b334-72a057f40ea0

Consumer credit hits a brick wall.

https://www.zerohedge.com/markets/consumer-credit-hits-brick-wall-credit-cards-maxed-out

Bottom line

More on valuation.

Why Goldman is buying every barrel of oil it

can find.

https://www.zerohedge.com/commodities/why-goldman-buying-every-barrell-oil-it-can-find

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment