Conoco Phillips one

of the world’s largest exploration and production (E&P) companies. Profits and

dividends have grown approximately 9-13% annually over the last 10 years. In the same time frame, COP

has earned between a 10-20% return on equity. The company should continue to

make progress as a result of:

(1) its exposure

to promising international regions,

(2) domestically,

its capital expenditures will focus the development of Eagle Ford Shale,

Permian, Bakken and Barnett fields,

(3) splitting

the exploration and production from the refining and marketing should unlock

value for shareholders,

(4) utilize its

strong cash flow to pay down debt, raise dividends and buy back stock.

Negatives:

(1) short term,

its production will be impacted by the shut down of its Libyan production,

(2) price

fluctuations of oil and natural gas,

(3) its

international operations are subject to political risks.

Conoco is rated

A++ by Value Line, has a 28% debt to equity ratio and its stock yields

approximately 4.6%.

Statistical Summary

Stock Dividend Payout # Increases

Yield Growth Rate Ratio

Since 2003

Debt/ EPS Down Net Value Line

Equity ROE Since 2003 Margin Rating

Chart

Note:

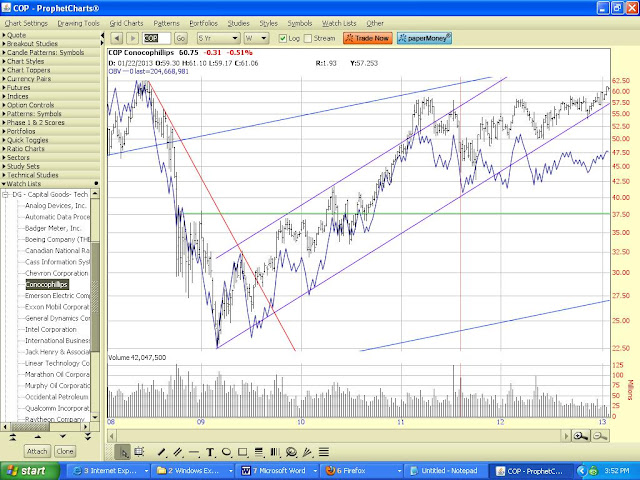

COP stock made good progress off its

March

2009 low, quickly surpassing the downtrend off its June 2008 high (red

line)

and the November 2008 trading high (green line). Long

term, COP

is in an uptrend (straight blue lines).

Intermediate term, it is in an uptrend (purple lines). The

wiggly blue line is on balance

volume. The Dividend Growth and High

Yield Portfolios own full positions in COP .

The upper boundary of its Buy

Value Range Sell

Half Range

No comments:

Post a Comment