The Morning Call

2/14/22

The

Market

Technical

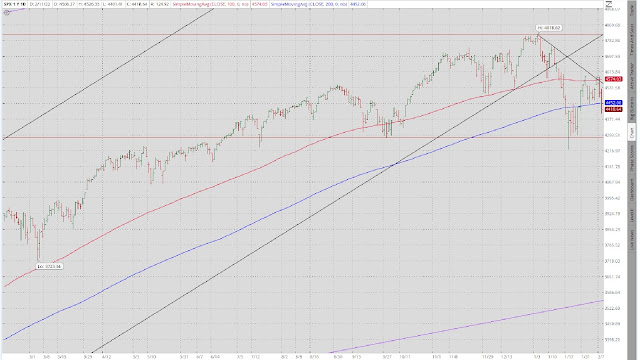

This

S&P chart is a pretty easy read. Last week, it challenged both its 100 DMA

and the upper boundary of that very short term downtrend---and failed---for the

second time in two weeks. That left the 100 DMA as resistance, marked a lower

high and added to the strength of that very short term downtrend’s upper boundary.

Even worse, it is now challenging its 200 DMA (now support; if it remains there

through the close on Wednesday, it will revert to resistance). If downward momentum

holds, then the lower boundary of its short term trading range is the next

support level. All that said, as you know the news flow was schizophrenic last week with wildly varying

news items on Fed policy as well as the ‘supposed’ Russian invasion of Ukraine.

This week will probably be more of the same. So, keep your directional

expectations on hold.

Friday’s strong

performance notwithstanding, the long bond is in a well-defined two month downtrend

and is nearing the lower boundary of its short term trading range. So, we now have near-in directional markers---the

upper boundary of the very short term downtrend and the lower boundary of the

short term trading range. For the moment, the assumption is that prices (rates)

are going lower (higher); but that will be put to the test when, as and if TLT challenges

the lower boundary of that short term trading range.

https://www.zerohedge.com/the-market-ear/mustknows

On

Friday, GLD challenged the upper boundary of the developing pennant formation

on huge volume---the volume suggesting continued momentum to the upside. Still,

I won’t consider the challenge successful until it has remained above that

boundary through the close on Tuesday. However, as I mentioned above, beware of

the volatility of the Fed and geopolitical headlines before making a

directional commitment.

The dollar failed

in the challenges of both the lower boundary of its short term uptrend and its

100 DMA, leaving in an uptrend and the 100 DMA as support. With caveat of

volatile headlines, my assumption remains that irrespective of what happens,

investors continue to believe that the dollar is a safe place to be.

Friday in the

charts.

https://www.zerohedge.com/markets/markets-turmoil-amid-russia-invades-reports-bullard-bombshell

Technically

speaking.

Stocks experiencing

big inflow in 2022.

https://www.zerohedge.com/markets/despite-turmoil-stocks-seeing-largest-ever-inflows-2022

Fundamental

Headlines

The

Economy

Review of last Week

The economic stats

were disappointing in total last week, with one negative primary indicator. So,

no follow through from the prior week’s slightly better than anticipated results.

Overseas, the numbers were again negative.

The one datapoint

that bears mentioning was the hotter than expected CPI number---which only the aggravates

the worries about an ever tighter monetary policy. Not that higher rates and

Quantitative Tightening aren’t needed to correct the gross distortions in the

pricing of risk and the income inequities caused by perpetually low rates and

QE. But, as I have constantly reminded you, it should have been done years ago;

and now a retreat from the extremes of overly expansive monetary policy will

unfortunately impose maximum pain on the economy and the Markets. Of course,

the Fed could always chicken out and retreat; but then it will have inadequately

dealt with inflation who’s its impact on the economy and Markets will worsen. As

I have said, the Fed has painted itself into a corner from which there is no

easy escape.

https://www.zerohedge.com/markets/time-different-feds-next-minsky-moment

The components of

the January CPI number.

https://www.advisorperspectives.com/dshort/updates/2022/02/11/january-inflation-the-components

Focusing on the wrong

variable for the wrong reasons.

The Fed’s dilemma.

https://www.capitalspectator.com/is-recession-the-only-cure-for-inflation/

How transitory is

inflation?

https://ritholtz.com/2022/02/transitory-longer/

The return of

global inflation.

On a more positive

note.

https://www.linkedin.com/in/edward-yardeni/recent-activity/

A Fed tightening is

not a near term threat.

https://scottgrannis.blogspot.com/2022/02/fed-tightening-is-not-near-term-threat.html

And last but not

least, the Fed will hold an unscheduled, closed meeting today.

https://www.zerohedge.com/markets/why-fed-holding-expedited-closed-board-meeting-monday

But then published

its latest POMO schedule which shows continuing QE and no rate hikes before the

March meeting. Confused? So is the Fed.

Which leaves me

with my economic outlook intact ---the economy is struggling to grow, hampered

by irresponsible monetary and fiscal policies, getting no support from the

global economy and threatened by (1) seemingly mounting inflationary forces and

(2) a more severe than anticipated retreat in economic activity.

US

International

Other

Updated Q1 nowcasts.

https://www.calculatedriskblog.com/2022/02/q1-gdp-forecasts-slightly-positive.html

Geopolitical

Ukraine president demands proof of US claims

about Russian invasion.

Bottom

line.

Will a single rate

hike kill the bull market?

https://compoundadvisors.com/2022/will-a-single-rate-hike-kill-the-bull-market

News on Stocks in Our Portfolios

FedEx (NYSE:FDX) declares $0.75/share quarterly dividend, in line with previous.

Illinois Tool Works (NYSE:ITW) declares $1.22/share quarterly dividend, in line with previous.

What

I am reading today

Why

ideology is the enemy of civilization.

The mathematical solution for

settling down.

https://politicalcalculations.blogspot.com/2022/02/the-37-percent-solution.html#.YgaxxN_MKUk

Winners of the ASTRO2021 photo

contest.

https://mymodernmet.com/save-a-star-astro2021-awards/

Quote of the day.

https://cafehayek.com/2022/02/quotation-of-the-day-3798.html?utm_source=feedburner&utm_medium=email

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment