The Morning Call

7/26/21

The

Market

Technical

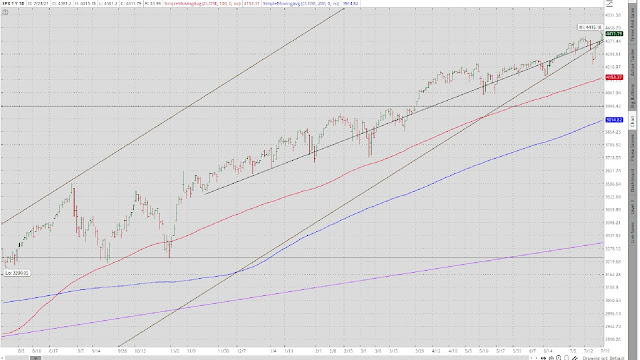

What a week. Monday, the S&P plummeted, challenging the

lower boundary of its short term uptrend.

It then soared the rest of the week, recovering all of Monday’s lost,

negating the aforementioned challenge and going on to make a new high. No better example of why I have been sticking

with my current short term pin action premise: ‘I can’t see an end to this

uptrend as long as the money keeps flowing with abundance and in the absence of

any major negative exogenous event.’

TLT’s performance

was the mirror image of equities. It

exploded on Monday; and while it mostly retreated for the balance of the week,

(1) it successfully challenged its 200 DMA [was resistance, now support] and

(2) remained in an uptrend off its May low.

That suggests a weaker economy which is not what stocks seem to be

discounting. As you may remember, those

two indices have been telling a different economic story for the past several

weeks, So, that continues. ‘Who is correct? As you

know, I believe that history has shown that the bond guys to get it right much more

often than their stock counterparts.’

Counterpoint

https://global-macro-monitor.com/2021/07/21/ignore-the-bond-market-flapdoodle/

GLD did not have

nearly as exciting a week. It did trade

down; but it is still not providing much informational value to the

schizophrenic behavior of the major markets.

You can see that support exists slightly lower at its 100 DMA.

Like gold, the

dollar had a relatively quiet week. However,

it regained its upward bias which argues for a stronger economic scenario. It was just the opposite the prior week. So also, like gold, there is not a lot of

informational value to be derived from its pin action.

Friday in the

charts.

https://www.zerohedge.com/markets/stocks-surge-after-monday-meltdown-bonds-bullion-black-gold-flat

Crypto markets

soar.

https://www.zerohedge.com/crypto/crypto-soars-higher-early-asia-trading-bitcoin-nears-40k

Seasonality pain?

https://www.zerohedge.com/the-market-ear/cqiz0dc36g

Fundamental

Headlines

The

Economy

Review of Last Week

The data releases

last week negative, as were the primary indicators (two negative, one neutral). So, the stats continue to confirm that the

post Covid burst of economic activity is slowing.

Overseas, the numbers

were neutral, making it still too soon to assume overall improvement.

The only other relatively

important news was the growing concern about the Covid delta variant---which, as you know, I think is much

less worrisome than the political and chattering classes. The danger here, of course, is that these

morons institute another lockdown.

Bottom line. ‘As

you know my opinion is that following an initial snapback (which may already

be over), the US economy will likely return to its former subpar secular growth

rate, stymied by an irresponsible mix of fiscal/monetary policies.’

US

International

The July Japanese

flash manufacturing PMI was 52.2 versus 52.4 in June; the flash services PMI was

46.4 versus 48.00 in June; the flash composite PMI was 47.7 versus 48.9 in

June.

The German

business climate index came in at 100.8 versus estimates of 102.1.

The

Fed

Survey on what economists think the Fed will

do.

Fiscal

Policy

The coming debt ceiling debate.

https://www.zerohedge.com/markets/how-much-risk-coming-debt-ceiling

Inflation

If inflation is transitory, why is this happening?

https://www.zerohedge.com/markets/if-inflation-was-transitory-would-not-be-happening

Global food supplies in jeopardy.

https://www.zerohedge.com/weather/worlds-food-supplies-jeopardy-amid-climate-disasters

An argument against inflation.

Bottom line.

Goldman’s risk appetite index crashes.

Druckenmiller says that this is the biggest

bubble in his career.

The problem with forward valuations (must

read).

https://www.zerohedge.com/markets/earnings-multiples-untold-truths-about-forward-valuations

News on Stocks in Our Portfolios

What

I am reading today

The highest forms of

wealth.

https://www.collaborativefund.com/blog/the-highest-forms-of-wealth/

Quote of the day.

Visit Investing for Survival’s

website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment