The Morning Call

1/14/19

The

Market

Technical

The

S&P was down fractionally on Friday.

Notice that it has struggled the last few trading days, unable to push

above a former support level (purple line).

It is also facing resistance from the upper boundary of its short-term

downtrend and the 61.8% Fibonacci level (a significant retracement [resistance]

level). It remains solidly below both

MA’s, with the 100 DMA about to push below its 200 DMA (a negative). Finally, breadth is rolling over. The one bright spot is that it still trades

within a very short-term uptrend. These

indicators suggest that short term weakness.

Whether that is a retreat in a developing uptrend or the last gasp

before challenging its December low remains to be seen.

And:

The

long bond was up 3/8 %, ending above both MA’s, in a very short-term uptrend, a

short-term trading range and appears to have failed to challenge its prior

higher low. That keeps this chart

strong, suggesting that rates have peaked, at least, short term.

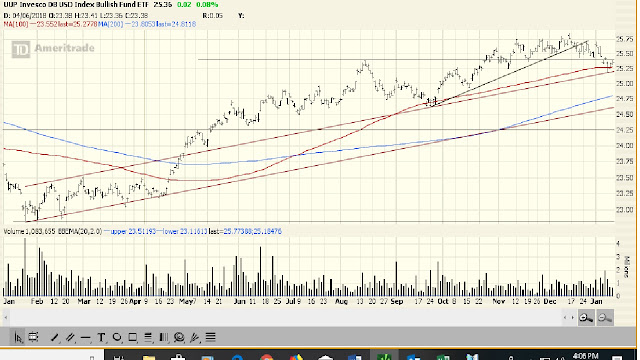

The

dollar was up again on Friday though not by much. Still it remains above both MA’s and it a short-term

uptrend, though it has struggled to make a new high of late. This performance suggests investors are

either betting that the US is going to be the strongest economy in a coming

global slowdown or that interest rates are going up---which I doubt.

The

GLD chart has gone from being ugly to, at least, tolerable. It remains above both MA’s, in a short-term

trading range and well above the lower boundary of a very short-term

uptrend. This pin action would be

compatible with lower rate/weaker economy scenario.

The

VIX had a much bigger down day on Friday than I expected on small down Market

day. Of course, it has not fallen nearly

as much as I anticipated on several recent large down day. So, it appears that there is some catch up in

the pin action. As you can see, it ended

below (1) the lower boundary of its very short-term uptrend [if it remains

there through the close today, the trend will be voided] and its 100 DMA [now

support; if it remains there through the close on Tuesday, it will revert to

resistance]. While it remains above its

200 DMA and in a short-term uptrend, the VIX’s chart is threatening to

deteriorate which would be a plus for stocks.

Fundamental

Headlines

Jeff

Gundlach: we are swimming in an ocean of debt.

Goldman

lowers its 2019 profit growth forecast.

News on Stocks in Our Portfolios

Economics

This Week’s Data

US

International

December Chinese exports fell

4.4% versus expectations of a rise of 2.2%; imports dropped 7.6 versus

estimates of a 3.4% increase.

November

EU industrial production declined 3.3% versus forecasts of down 2.1%.

Other

What

I am reading today

Quote of the day.

France and

Germany merge economic and defense polices---something Hitler could not do.

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment