The Morning Call

11/15/21

The

Market

Technical

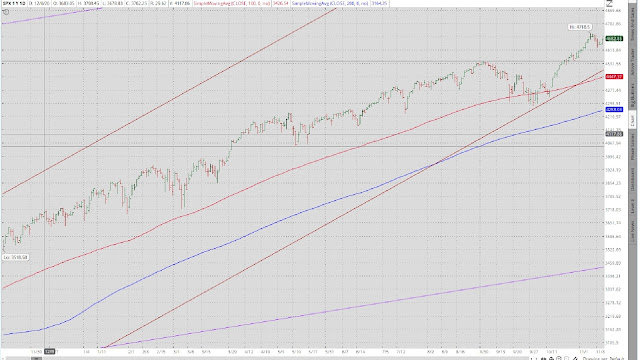

The S&P consolidated

a bit last week; but nothing that would suggest a reversal of fortune. To repeat: ‘If a picture is worth a

thousand words, then I don’t need to say anything. The upward seasonal bias seems in place. Sit back and enjoy it.’

The pain trade is

till to the upside.

https://www.zerohedge.com/the-market-ear/c5vwazi1q4

Buy the dip.

https://www.zerohedge.com/the-market-ear/cnhranjg5a

While the pin

action in the long bond remains a bit confusing, looking at a longer term chart

provides some perspective. As you can

see, it has bounced off the upper boundary of its long term uptrend three times

in the recent past. That would be

expected and would in no way call into question the long term uptrend

(downtrend) in price (yield). Also

notice a fairly easily distinguishable head and shoulders formation which

suggests additional short term downward pressure in bond prices as that pattern

completes itself---also to be expected as inflationary concerns appear to be

kicking into high gear.

That would suggest

the conclusion that the chart is telling us that prices (rates) will likely go

lower (higher) near term as inflation anxiety continues to mount. But ultimately, the Fed has to tighten (which

may take prices [rates] even lower [higher]), slowing the economy which will

lead to the continuation of the long term uptrend in prices. However, that is getting way too far ahead

of ourselves. I settle for higher rates

likely near term.

For the first time in a month, GLD didn’t stage a

major price reversal last week. It

continued its surge higher, suggesting the gold is regaining some of its

panache as an inflation hedge. However,

two good weeks hardly make a trend; so for the moment, I am just watching.

The dollar

continues to follow stocks up. Last

week, it successfully challenged the upper boundary of its short term trading

range and reset to an uptrend. As I

noted last week ‘This…is

in line with the aforementioned ‘investors/jiggy/buying everything’

scenario. However, it may also be reflecting

investor conviction that whatever the economy/Fed/ Biden does, the US will

still be a better place to invest than anywhere else on the planet.’

https://www.reuters.com/business/dollar-set-biggest-weekly-rise-5-months-yields-rise-2021-11-12/

Friday in the

charts.

Fundamental

Headlines

The

Economy

Review of Last Week

Last week was very

quiet with respect to the economic stats.

In the US, they were slightly negative; though it is important to point about

that the inflation numbers were hotter than anticipated.

Also, a slow week

for international data. It was slightly

positive. But again, the inflation stats

did not make good reading.

My take on the

economy remains unchanged---it is struggling to grow, hampered by increasingly

irresponsible monetary and fiscal policies, getting no support from the global

economy and threatened by seemingly mounting inflationary forces. (see below)

US

International

Q3 preliminary

Japanese GDP was up 1.9% versus estimates of -0.7%; Q3 preliminary capital

expenditures was +1.4% versus -0.6%; Q3 preliminary private consumption was

+0.9% versus -0.4%; September industrial production was -3.6% versus -5.4%.

October YoY

Chinese industrial production was up 3.1% versus consensus of +2.9%; October

YoY retail sales were up 4.4% versus +3.6%; October YoY fixed asset investment was

up 7.3% versus +6.5%.

Other

The latest Atlanta Fed GDP nowcast.

https://www.atlantafed.org/cqer/research/gdpnow

Inflation

The risk of recession is low but the risk of inflation

is high.

http://scottgrannis.blogspot.com/2021/11/recession-risk-is-very-low-but.html

More on rising wages.

https://compoundadvisors.com/2021/higher-wages-are-not-transitory

Inflation angst.

https://www.zerohedge.com/markets/frogs-will-get-boiled-regime-change-coming

On

the other hand, some assets appear to be fading an inflationary surge.

https://www.zerohedge.com/the-market-ear/beyond

Bottom line.

Cash as an

investment hedge.

https://www.zerohedge.com/markets/cash-good-risk-hedge

News on Stocks in Our Portfolios

What

I am reading today

Visit Investing for Survival’s

website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment