The Morning Call

8/12/19

The

Market

Technical

My charting

service has changed its format. It is obvious

in the way the charts are presented. This

new system is having its problems that are sure to be ironed out. One of them is that their logarithm scales don’t

work on long time horizons. So at the moment,

I can’t plot some intermediate and long term trends including those of the Averages.

The good news is that neither are even remotely close to those trend

lines. In the meantime, bear with me.

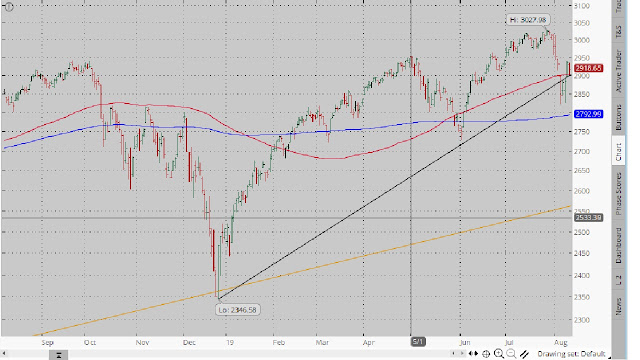

It was a busy week

for the S&P: (1) it voided its very

short term uptrend but quickly regained the lower boundary. If it remains there for a couple more days, I

will re-instate that trend, (2) it also reset its 100 DMA from support to

resistance and one day later traded back above that MA. I also have this change on hold, and (3) it

closed Monday’s gap down opens.

The

long bond is smoking. It is above both

MA’s and in uptrends across all timeframes.

The only technical negative is a short term one---last Monday’s gap up

open that needs to be closed.

The

dollar remains strong. It is in short and

long term uptrends and above both MA’s.

Plus, it needs to close Monday’s gap down open. However, after it took out the upper boundary

of its long term trading range, it traded back below that level and has

remained there. That is a bit worrisome.

Gold continues to

soar. It remains in very short term and

short term uptrends and above both MA’s.

In

its latest spike, the VIX made a higher low and a higher high in addition to

resetting both MA’s to support. That suggests

a lot more caution that is not being reflected in stock prices.

Fundamental

Headlines

Risk happens fast.

QE returning to a

market near you.

If you don’t want

to be depressed, don’t read this. The

latest from David Rosenberg.

News on Stocks in Our Portfolios

Economics

This Week’s Data

US

International

June

Chinese vehicle sales fell 4.3% versus estimates of -8.0%.

July

Chinese outstanding loan growth equaled 12.6% versus forecasts of 12.7%.

Other

Shipping

fuel prices declining.

Farm loan delinquencies and bankruptcies

increasing.

Protests in Hong Kong gather more steam.

The future of the EU (must read):

What

I am reading today

Quote of the

day.

Visit Investing

for Survival’s website (http://investingforsurvival.com/home)

to learn more about our Investment Strategy, Prices Disciplines and Subscriber

Service.

No comments:

Post a Comment